| ☐ | Soliciting Material Pursuant to §240.14a-12 |

pSivida Corp.

EyePoint Pharmaceuticals, Inc. (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): | | ☐ | Fee paid previously with preliminary materials. | | | ☐ | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

480 Pleasant Street Watertown, MA 02472 United States November 13, 2017May 9, 2022

Dear

To Our Fellow Stockholders, It is

2021 was a tremendous year for EyePoint Pharmaceuticals as we continued to execute on our pleasure to invite you togoal of becoming the leader in ocular drug delivery. We made strides across virtually all of our business endeavors, including the achievement of our most important milestone: the reporting of positive data from the Phase I DAVIO clinical trial for our lead pipeline program, EYP-1901, in wet-age related macular degeneration (wet AMD). We also significantly strengthened our balance sheet and recorded strong year over year revenue growth from our commercial products, YUTIQ® and DEXYCU®. Financially, we accomplished a very important annual meetinggreat deal in 2021 as well. We completed two successful follow-on equity offerings raising over $230 million in gross proceeds and we ended the year with cash, cash equivalents and investments totaling $211.6 million. In March 2022, we announced a debt refinancing with Silicon Valley Bank, with $45 million in credit facilities replacing our prior credit facility and representing a significant improvement in economic terms, resulting in approximately $2.8 million of stockholders of pSivida Corp. (the “Company”), which will be held on Friday, December 15, 2017, at 9:00 a.m. U.S. Eastern Standard Time, at pSivida’s Corporate Headquarters, 480 Pleasant Street, Watertown, Massachusetts 02472, in order to vote on the proposals disclosed in the accompanying proxy statement. Since my arrival at pSivida in September 2016, I,annualized interest savings. We are incredibly pleased with our improved balance sheet and we anticipate that cash and investments along with net proceeds from our commercial products can fund current and planned operations into the Boardsecond half of Directors and senior management, have worked diligently to establish a clear vision for pSivida. Our primary objectives are to become a fully integrated commercial stage pharmaceutical enterprise and to increase the utilization of our proprietary technology. In order to achieve these two objectives, which should result in increased stockholder returns compared to historical results, we set a number of near- and long-term goals. I am pleased to report that we have met or exceeded all of these goals first shared with you in late 2016:2024.

We completed and reportedare excited about the potential benefits that our three-year treatment for posterior segment uveitis successfully achieved its primary efficacy endpoint in the second Phase 3 study; pipeline product candidates may bring to patients with serious eye disorders. We consummated a Europeanout-license forbelieve our Durasert three-year posterior segment uveitislead product candidate, transferring regulatory and commercialization responsibility in that territoryEYP-1901, has the potential to Alimera; | • | | In addition, we further amended our existing Alimera collaboration agreementbe a new treatment paradigm for serious retinal diseases, including wet AMD, if approved. As a potential six-month sustained release treatment option using our bioerodible DURASERT technology, EYP-1901 can deliver small molecule drugs to convert the previous profit share arrangement for ILUVIEN® for DME to a tiered sales-based royalty, providing improved and more predictable long-term revenue generation; |

We have entered into three new feasibility study agreements with pharmaceutical companies for front of the eye (glaucoma) and back of the eye diseases. These agreements leveragefor extended periods of time with a consistent, sustained release profile known as zero order kinetics. Wet AMD is a serious and potentially devastating eye disorder, accounting for approximately 90% of all AMD-related blindness. Despite FDA-approved medications on the market, treatment adherence remains an ongoing challenge for patients and physicians, and we continue to believe that there is a significant unmet need for longer duration treatments for wet AMD.In 2021, we dosed the first patient with EYP-1901 in our proven DurasertPhase 1 wet AMD DAVIO clinical trial, completed trial enrollment, reported positive 30-day and 3-month safety data, and presented positive interim 6-month safety and efficacy data. In February 2022, we reported continued strong safety and efficacy signals in updated 8-month data. We are encouraged by our interim DAVIO results thus far, and believe these data demonstrate the sustained delivery potential of what our DURASERT technology and expand potential future sources ofnon-dilutive funding; and In collaborationWe plan to advance a Phase 2 trial of EYP-1901 for wet AMD starting in the third quarter of 2022, and we look forward to expanding this potentially paradigm-changing treatment to additional indications with Hospital for Special Surgery (HSS)unmet need, including non-proliferative diabetic retinopathy (NPDR), in the second half of this year. Regarding our commercial products, YUTIQ® and DEXYCU®, we completed patient enrollmentare very pleased by the progress we’ve made this past year. We reported record customer demand for both our commercial products in the fourth quarter of 2021 and a Phase I investigator-sponsored study70% increase in net product revenue for pain relieffull-year 2021 compared to full-year 2020. In December 2021, we signed an amendment to our commercial alliance agreement with ImprimisRx, under which ImprimisRx assumed full responsibility for U.S. sales and marketing activity for DEXYCU as of knee osteoarthritis (OA). Our progressJanuary 2, 2022. ImprimisRx has acceleratedbeen a strong partner for DEXYCU and we look forward to continued growth of the franchise as they continue to execute. In addition, YUTIQ customer demand continues to grow due to our trajectory has changed,ongoing expansion of YUTIQ sales efforts into the retinal community for the better. The reprioritizationtreatment of pSivida’s developmentposterior segment uveitis, and collaboration programsfrom an improved siliconized needle that provides a preferred procedural experience for physicians and patients. Our commercial products provide a unique value proposition of sustained drug delivery allowing for potentially fewer treatments, which we believe continues to increasebe highly attractive to both doctors and patients.

Throughout the numberyear, we strengthened our management team with key leadership appointments. In the fourth quarter of opportunities2021, Jay S. Duker, M.D. became our full-time Chief Operating Officer. Dr. Duker is a world-renowned retinal surgeon and a leading key opinion leader with over 300 publications. Prior to acceleratejoining EyePoint as COO, Dr. Duker served as Chair of Ophthalmology at Tufts Medical School for over 20 years. Additionally, in January 2022, we appointed Michael C. Pine as Chief Corporate Development and Strategy Officer, bringing with him over 20 years of business and corporate development expertise in the pharmaceutical industry. Most recently, in March 2022, we announced the hiring of our growth. OverChief Regulatory Officer, Isabelle Lefebvre, who brings over 30 years of global regulatory affairs experience across all phases of drug development, including ophthalmic and ocular conditions. We are also pleased to announce a new nominee to our Board of Directors, Anthony Adamis, M.D., pioneer in the next few months, we have a numberdiscovery and early development of key milestones,anti-VEGF drugs for the most significanttreatment for ophthalmic diseases. Dr. Adamis has more than 30 years of which,industry R&D experience, having guided the development of course, is filing our New Drug Application (NDA) for Durasert three-year posterior segment uveitis. We have received positive input from20 medicines in global clinical trials, resulting in 23 approvals by the U.S. Food and Drug Administration (FDA), are executingAdministration. In closing, 2021 was a critical year for EyePoint Pharmaceuticals as we believe we established our submission plancompany as a strong clinical and expect to file the NDA in late December 2017 or early January 2018. Other milestones include the12-month efficacy read out for our second Phase 3 studycommercial leader in the first halfretinal ophthalmic space. We are deeply grateful for the dedication and drive of calendar 2018our employees, as well as the clinical investigators and similarpatients in our Phase 1 DAVIO clinical trial, who made these achievements possible. We remain focused on our overarching mission of improving the lives of patients with serious eye disorders by bringing innovative products to 2017,patients in the United States and around the world, and we expect leading uveitis expertscontinue making progress toward achieving our goal to continue presenting clinical study data at leading medical conferences and reinforcing positive clinical outcomes.become the leader in ocular drug delivery. In addition

We would like to thank our Durasert three-year posterior segment uveitis product candidate, we are also excited about the potential for our shorter duration nine-month Durasert product candidate. We know retina specialists generally prefer drug treatments that offer multiple dosing options, and uveitis is no exception. Consequently, we believe this could have significant value to them as they treat their patients. In market research that we performed

and shared with you earlier this year, physicians were very favorably inclined to use both shorter-duration and three-year duration treatment regimenscommitted stockholders for their uveitis patients.

Most importantly, we have commenced commercial planning for our potential posterior segment uveitis launch in the U.S market that, assuming a normal FDA review period and approval, could occur as early as the calendar 2019 first quarter. As I have communicated previously, commercializing this asset directly in the U.S. requires upfront investment, but positions pSivida for long-term profitability and growth. We believe launching Durasert three-year posterior segment uveitis ourselves is critical to driving revenue, future profitability and stockholder returns. Furthermore, we have the leadership team in place to maximize the U.S. commercial opportunity, a team that has previously launched dozens of drugs and generated significant revenue. Uveitis, which is the third leading cause of blindness in the developed world, has a relatively modest prevalence and small number of specialized physicians who treat it. Therefore, we anticipate launching with a small, highly focused contract field force, thereby limiting our commercial cost outlays.

Our operating performance these past 12 months demonstrates that we are working hard to ensure that the Company’s potential is fully realized. We are optimistic that, if approved by the FDA, the combination of our low cost of goods and a fair price should allow us to achieve a profitable product within a few years from launch and to begin to provide our stockholders a better rate of return compared to our historical globalout-license strategy. We have proven technology, leadership andin-depth scientificknow-how, and I am confident in our ability to continue executing on our deliverables.

In connection with this annual meeting, all stockholders and holders of CHESS Depositary Interests (“CDIs”) are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, we urge you to submit your proxy card or CDI voting instruction form as soon as possible so that your shares (or shares underlying your CDIs) can be voted at the meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions on the proxy card or CDI voting instruction form.

We are delivering paper copies of our proxy materials to all of our stockholders and CDI holders. In addition, the Notice of Annual Meeting, proxy statement, proxy card and CDI voting instruction form are available on the following websites:www.edocumentview.com/PSDV for street holders andwww.envisionreports.com/PSDV for registered holders.

Your vote is very importantcontinued support, and we encourage youlook forward to vote promptlyfuture successes as we continue to work towards achieving our corporate and affirmatively for the proposals. As a Delaware corporation and under our bylaws, a minimum ofone-third of our outstanding shares of common stock (including shares underlying our outstanding CDIs) must be present in person or represented by proxy at the meeting in order for the meeting to be considered valid. You may vote your shares online, by telephone or by mailing a completed proxy card if you elect to receive the proxy materials by mail. Instructions regarding each method of voting are provided on the proxy card. CDI holders may vote the shares underlying their CDIs only by written instruction to the CDI depositary. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Yours sincerely,clinical goals.

Sincerely,

Nancy Lurker President and Chief Executive Officer ii

This letter to stockholders includes “forward-looking statements” within the meaning

Göran Ando, M.D. Chair of the “safe harbor” provisionsBoard of Directors

SAFE HARBOR STATEMENTS UNDER THE PRIVATE SECURITIES LITIGATION ACT OF 1995: To the extent any statements made in this letter deal with information that is not historical, these are forward-looking statements under the Private Securities Litigation Reform Act of 1995. You should be awareSuch statements include, but are not limited to, statements identified by words such as “will,” “potential,” “could,” “can,” “believe,” “intends,” “continue,” “plans,” “expects,” “anticipates,” “estimates,” “may,” other words of similar meaning or the use of future dates. Forward-looking statements by their nature address matters that our actual results could differ materially from those contained in the forward looking statements. Among the factors that couldare, to different degrees, uncertain. Uncertainties and risks may cause EyePoint’s actual results to differbe materially fromdifferent than those indicatedexpressed in or implied by EyePoint’s forward-looking statements. For EyePoint, this includes uncertainties regarding the forward-looking statements are riskstiming and uncertainties inherent inclinical development of our product candidates, including EYP-1901; the effectiveness and timeliness of clinical trials, and the usefulness of the data; the timeliness of regulatory approvals; the extent to which the COVID-19 pandemic impacts EyePoint’s business, including, without limitation: ourthe medical community and the global economy; EyePoint’s ability to achieve profitable operations and access to needed capital; fluctuations in ourEyePoint’s operating results; successful commercialization of, and receipt of revenues from, ILUVIEN for diabetic macular edema, which depends on Alimera’s ability to continue as a going concern; Alimera’s ability to obtain marketing approvals and the effect of pricing and reimbursement decisions on sales of ILUVIEN; the number of clinical trials and data required for the Durasert three-year uveitis marketing approval application in the United States; our ability to file and the timing of filing and acceptance of the Durasert three-year uveitis NDA in the United States; our ability to use data in a United States NDA from clinical trials outside the United States; ourEyePoint’s ability to successfully produce sufficient commercial quantities of YUTIQ and DEXYCU and to successfully commercialize Durasert three-year uveitis, if approved,YUTIQ and DEXYCU in the United States; potentialoff-label salesU.S.; EyePoint’s ability to sustain and enhance an effective commercial infrastructure and enter into and maintain commercial agreements for the commercialization of ILUVIEN for uveitis;YUTIQ and DEXYCU; consequences of fluocinolone acetonidedexamethasone side effects; the development of our next-generation Durasert shorter-duration treatmenteffects for posterior segment uveitis; potential declines in Retisert® royalties; efficacy and our future development of an implant to treat severe osteoarthritis; our ability to successfully develop product candidates, initiate and complete clinical trials and receive regulatory approvals; our ability to market and sell products;DEXYCU; the success of current and future license agreements, including our agreement with Alimera; termination or breach of current license agreements, including our agreement with Alimera; ouragreements; EyePoint’s dependence on contract research organizations, contract sales organizations co-promotion partners, and other outside vendors and investigators;service providers; effects of competition and other developments affecting sales of products; market acceptance of products; effects of guidelines, recommendations and studies; protection of intellectual property and avoiding intellectual property infringement; retention of key personnel; product liability; industry consolidation; compliance with environmental laws; manufacturing risks; risks and costs of international business operations; effects of the potential United Kingdom exit from the European Union; legislative or regulatory changes; volatility of stock price; possible dilution; absence of dividends; and other factors described in our filings with the Securities and Exchange Commission. You should readWe cannot guarantee that the results and interpretother expectations expressed, anticipated or implied in any forward-looking statementsstatement will be realized. A variety of factors, including these risks, could cause our actual results and other expectations to differ materially from the anticipated results or other expectations expressed, anticipated or implied in light of these risks.our forward-looking statements. Should known or unknown risks materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected in the forward-looking statements. You should bear this in mind as you consider any forward-looking statements. Our forward-looking statements speak only as of the dates on which they are made. We do not undertake any obligation to publicly update or revise our forward-looking statements even if experience or future changes makes it clear that any projected results expressed or implied in such statements will not be realized.realized. iii

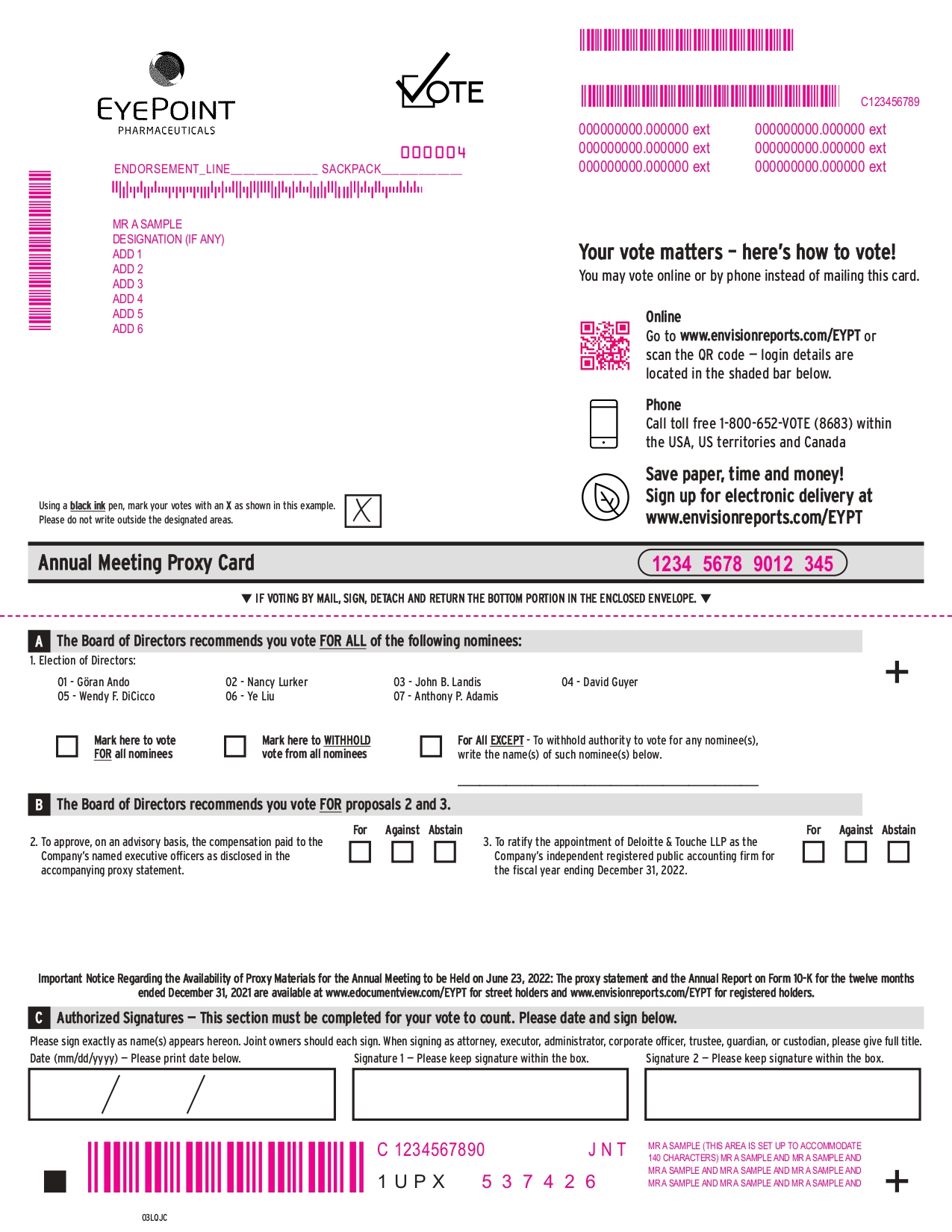

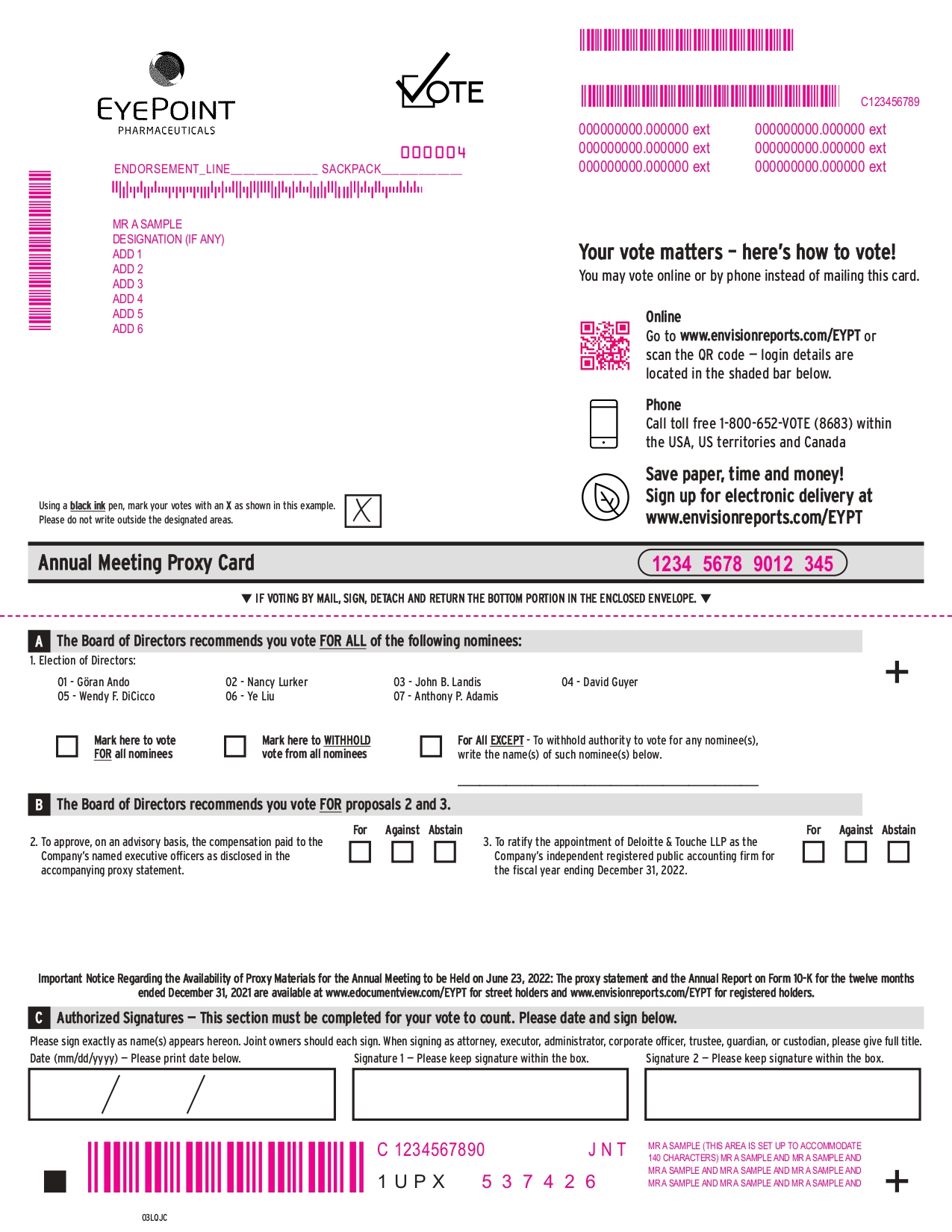

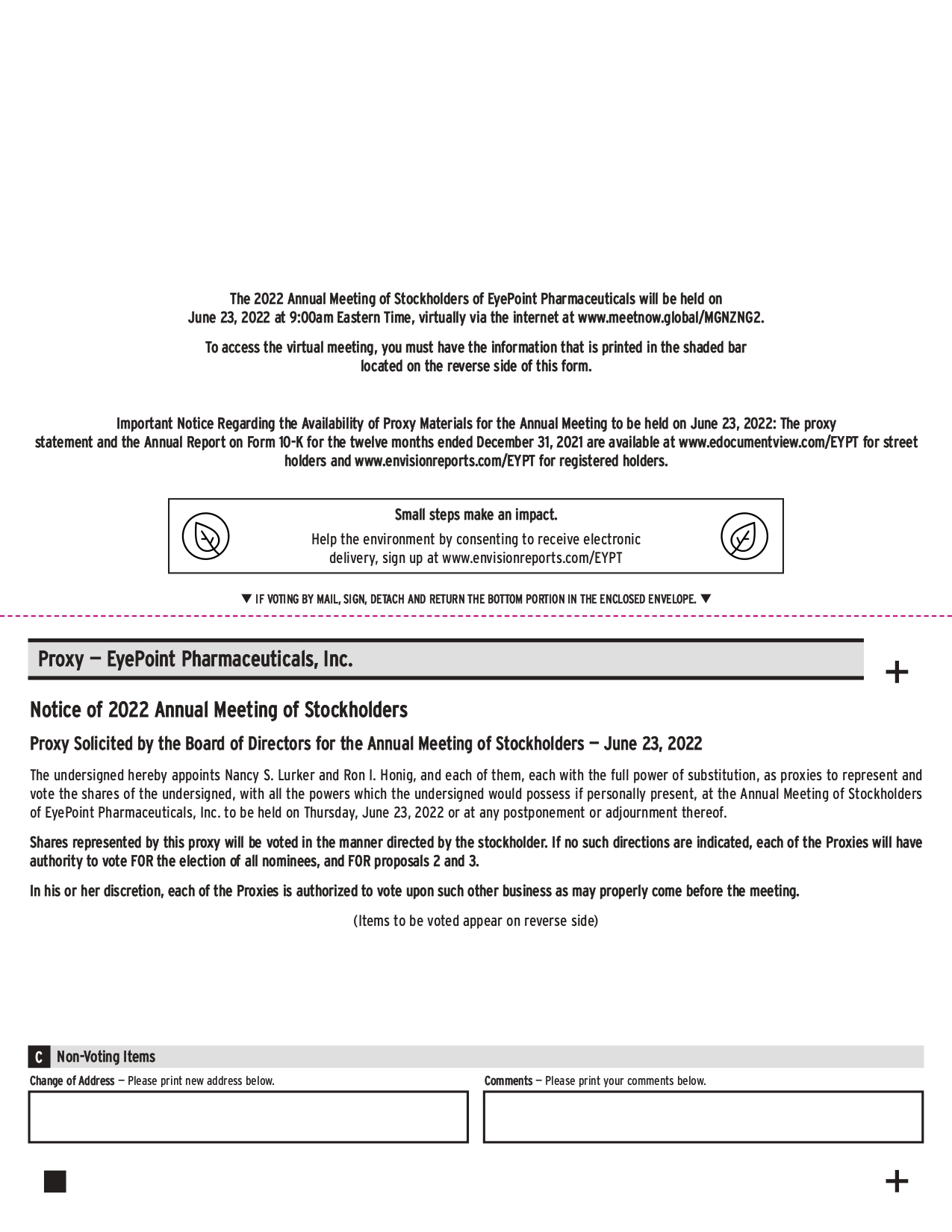

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD DECEMBER 15, 2017JUNE 23, 2022 Dear Stockholders: NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (Annual Meeting) of EyePoint Pharmaceuticals, Inc. (the “Annual Meeting”) of pSivida Corp. (the “Company”)Company) will be held on Friday, December 15, 2017,Thursday, June 23, 2022 at 9:00 A.M. U.S. Eastern Standard Time, ata.m., local time. This year’s Annual Meeting will be a virtual meeting via live webcast on the Company’s Corporate Headquarters, 480 Pleasant Street, Watertown, Massachusetts 02472, Internet. You will not be able to attend the Annual Meeting in person. Instead,you will be able to attend the Annual Meeting by visiting www.meetnow.global/MGNZNG2, for the following purposes: | 1. | To elect seven directors to the Company’s boardBoard of directors. |

| 2. | For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 7.4 and for all other purposes,Directors, each to ratify the issuance of 5,900,000 shares of Company common stock, par value US$0.001 per share (the “Common Stock”) between July 24, 2017 and November 7, 2017 on the terms and conditions disclosed in the accompanying proxy statement to refreshserve until the Company’s capacity to issue shares2023 Annual Meeting of Common Stock without prior stockholder approval pursuant to ASX Listing Rule 7.1.Stockholders or until such person’s successor is duly elected and qualified. |

| 3.2. | For the purposes of ASX Listing Rule 7.1A and for all other purposes, to approve the issuance of equity securities up to an additional 10% of the issued capital of the Company over a 12 month period, pursuant to ASX Listing Rule 7.1A, on the terms and conditions disclosed in the accompanying proxy statement. |

| 4. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 240,000 stock options, 120,000 restricted stock units and 115,000 performance stock units to Nancy Lurker on the terms disclosed in the accompanying proxy statement. |

| 5. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 17,500 deferred stock units to David J. Mazzo on the terms disclosed in the accompanying proxy statement. |

| 6. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to Michael W. Rogers on the terms disclosed in the accompanying proxy statement. |

| 7. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to Douglas Godshall on the terms disclosed in the accompanying proxy statement. |

| 8. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to James Barry on the terms disclosed in the accompanying proxy statement. |

| 9. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 20,000 stock options and 12,500 deferred stock units to Jay Duker on the terms disclosed in the accompanying proxy statement. |

| 10. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 40,000 stock options to Kristine Peterson on the terms disclosed in the accompanying proxy statement. |

| 11. | To approve, on an advisory basis, the compensation paid to the Company’s named executive compensationofficers as disclosed in the accompanying proxy statement. |

| 12.3. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2018.December 31, 2022. |

| 13.4. | To transact such other business as may properly come before the meeting or any adjournment or postponement of the Annual Meeting. |

The Company’s Board of Directors recommends that stockholders voteFOR ALL on Proposal No. 1 andFOR Proposal Nos. 2 through 12, except for Nancy Lurker (with respectand 3. During the ten days before the Annual Meeting, you may inspect a list of stockholders eligible to Proposal No. 4 only), David J. Mazzo (with respectvote. If you would like to Proposal No. 5 only), Michael W. Rogers (with respectinspect the list, please call John Mercer, our Director of IP and Corporate Counsel, at (508) 934-6243 to Proposal No. 6 only), Douglas Godshall (with respect to Proposal No. 7 only), James Barry (with respect to Proposal No. 8 only), Jay Duker (with respect to Proposal No. 9 only), and Kristine Peterson (with respect to Proposal No. 10 only), each of whom abstains from making a recommendation with respect toarrange the specified Proposal due to his or her interest in that Proposal.inspection. Stockholders of record and holders of record of CHESS Depositary Interest (“CDIs”) at the close of business on November 10, 2017 (U.S. Eastern Standard Time),April 25, 2022, the record date of the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement of the meeting. A list Important notice regarding the availability of stockholders as of the record date will be availableproxy materials for stockholder inspection at the Annual Meeting to be held on June 23, 2022. Our 2022 Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021 are available at the Company’s executive offices at 480 Pleasant Street, Watertown, Massachusetts 02472 during normal business hours from November 10, 2017 to the date of the Annual Meeting. CDIwww.edocumentview.com/EYPT for street holders may instruct CHESS Depositary Nominees Pty Limited, the record holder of the Common Stock underlying the CDIs, to vote on their behalf in accordance with the voting procedures set forth in the accompanying proxy statement and the CDI voting instruction form.www.envisionreports.com/EYPT for registered holders. The accompanying proxy statement includes further details with respect to the proposals to be considered at the Annual Meeting. This notice of Annual Meeting and the accompanying proxy statement contain important information and should be read in their entirety. If you are in doubt as to how you should vote at the Annual Meeting, you should seek advice from your legal counsel, accountant or other professional adviser prior to voting. |

By Order of the Board of Directors | John D. Mercer

| Secretary

November 13, 2017

Watertown, Massachusetts

| ii

| Ron Honig |

| Table of ContentsChief Legal Officer and Company Secretary

|

May 9, 2022 Watertown, Massachusetts

Table of Contents

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 15, 2017

|

In this proxy statement, the words “EyePoint,” “the Company,” “we,” “our,” “ours,” “us” and similar terms refer to EyePoint Pharmaceuticals, Inc. and its consolidated subsidiaries, unless the context indicates otherwise. The Notice of 2022 Annual Meeting of Stockholders and Proxy Statement and our accompanying Annual Report on Form 10-K are being distributed and made available on or about May 9, 2022.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND VOTING Proxy Materials Why am I receiving these proxy materials? Our Board of Directors (Board) has made these proxy materials available to you on the Internet, or, upon your request, has delivered a printed or email copy of these proxy materials to you, in connection with its solicitation of proxies for use at our 2022 Annual Meeting of Stockholders (Annual Meeting), which will take place on Thursday, June 23, 2022 at 9:00 a.m., local time, via live webcast on the Internet by visiting www.meetnow.global/MGNZNG2. We began sending the Notice of Internet Availability of Proxy Materials (Notice) on or about May 9, 2022. You received proxy materials because you owned shares of EyePoint common stock at the close of business on April 25, 2022 (the Record Date), and that entitles you to vote at the Annual Meeting. These proxy materials describe the matters on which our Board of Directors would like you to vote and contain information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (SEC) when we solicit your proxy. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 23, 2022. Our 2022 Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2021 are available at www.edocumentview.com/EYPT for street holders and www.envisionreports.com/EYPT for registered holders. What is included in the proxy materials? The proxy materials include: the Notice of 2022 Annual Meeting of Stockholders and Proxy Statement (Proxy Statement); our Annual Report on Form 10-K for the year ended December 31, 2021 (Annual Report); and if you requested a printed or email copy of these proxy materials, the proxy or voting instruction card that accompanied these materials. What information is contained in this Proxy Statement and our Annual Report on Form 10-K? The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and certain of our executive officers, corporate governance matters, and certain other required information. Our Annual Report contains information about our business, our audited financial statements and other important information that we are required to disclose under the rules of the SEC. Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? In accordance with SEC rules, we may furnish proxy materials, including this Proxy Statement and our Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy or voting instructions on the Internet. If you would like to receive a paper or email copy of the proxy materials, you should follow the instructions in the Notice for requesting such materials. How can I access the proxy materials over the Internet? The Notice and, if you requested to receive a printed or email copy of these proxy materials, the proxy or voting instruction card that accompanied these materials, contains instructions on how to: view the proxy materials for the Annual Meeting on the Internet and vote your shares; and instruct us to send our future proxy materials to you electronically by email. 1

Our proxy materials are also available at www.edocumentview.com/EYPT for street holders and www.envisionreports.com/EYPT for registered holders. Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it. Voting Information What items of business will be voted on at the Annual Meeting? The items of business scheduled to be voted on at the Annual Meeting are: Proposal No. 1: | To elect seven members of our Board of Directors, (the “Board”) is soliciting your proxy for use at the annual meeting of stockholders (the “Annual Meeting”),each to be held on Friday, December 15, 2017, at 9:00 A.M. U.S. Eastern Standard Time atserve until our Corporate Headquarters, 480 Pleasant Street, Watertown, Massachusetts 02472, or any adjournment or postponement thereof, for the purposes set forth in the accompanying notice and this proxy statement. This proxy statement relates to the solicitation of proxies by the Board for use at the Annual Meeting. In this proxy statement, the words “pSivida,” “the Company,” “we,” “our,” “ours,” “us” and similar terms refer to pSivida Corp., unless the context indicates otherwise.

On or about November 15, 2017, we began sending this proxy statement, the attached Notice of2023 Annual Meeting of Stockholders proxy card, CDI Voting Instruction Form and Annual Report, which includes our financial statements for the fiscal year ended June 30, 2017 (“Annual Report”), to all stockholders entitled to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON DECEMBER 15, 2017: We are delivering to all stockholders paper copies of all proxy materials. In addition, a complete set of proxy materials relating to the Annual Meeting is available on the Internet. These materials, consisting of the notice of Annual Meeting, this proxy statement, the Annual Report for our fiscal year ended June 30, 2017, proxy card and CDI voting instruction form, are available on the following websites:www.edocumentview.com/PSDV for street holders andwww.envisionreports.com/PSDV for registered holders.

SOLICITATION AND VOTING

Voting Rights and Procedures

Only those stockholders of record and holders of record of CHESS Depositary Interests (“CDIs”) as of the close of business on November 10, 2017 (U.S. Eastern Standard Time), the record date, will be entitled to vote at the Annual Meeting and any adjournment or postponement thereof. Those persons holding CDIs are entitled to receive notice of and attend the Annual Meeting and may instruct CHESS Depositary Nominees Pty Limited (“CDN”) to vote at the meeting by following the instructions on the CDI voting instruction form.

As of the record date, we had 45,256,999 shares of our common stock, par value US$0.001 per share (the “Common Stock”), outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder as of the close of business on the record date is entitled to one vote for each share of Common Stock held byuntil such stockholder. Each CDI holder as of the close of business on the record date is entitled to direct CDN, the record holder of the Common Stock underlying our CDIs, to vote one share for every CDI held by such holder.

BrokerNon-Votes

If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker with voting instructions, your shares may constitute “brokernon-votes.” Brokernon-votes occur on a

matter when the broker is not permitted under applicable stock exchange rules to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as“non-routine” matters.

At the Annual Meeting, Proposal Nos. 1 through 11 are considered“non-routine” matters while Proposal No. 12 is considered a “routine” matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, your shares will not be voted on Proposal Nos. 1 through 11 and a brokernon-vote will occur on these matters. In tabulating the voting result for any particular proposal, shares that constitute brokernon-votes are not considered voting power present with respect to that proposal. Thus, brokernon-votes will not affect the outcome of Proposal Nos. 1 through 11, assuming that a quorum is obtained.

Quorum

A “quorum” is necessary to conduct business at the Annual Meeting.One-third of the outstanding shares of our Common Stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Abstentions and brokernon-votes will be counted as present for purposes of determining a quorum at the Annual Meeting. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

Voting Requirements

| • | | Proposal No. 1: Elect seven directors to the Board.Votes may be cast:FOR ALL nominees,WITHHOLD ALL nominees orFOR ALL EXCEPT those nominees noted by you on the appropriate portion of your proxy or voting instructions. A plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting is required to elect director nominees, and as such, the seven nominees who receive the greatest number of votes of the shares present in person or presented by proxy at the Annual Meeting will be elected. Brokernon-votes and abstentions will have no effect on the outcome of this proposal. |

| • | | Proposal No. 2: Ratify the issuance of 5,900,000 shares of Common Stock between July 24, 2017 and November 7, 2017 pursuant to Australian Securities Exchange (“ASX”) Listing Rule 7.4 on the terms and conditions disclosed in this proxy statement to refresh our capacity to issue shares of Common Stock without prior stockholder approval pursuant to ASX Listing Rule 7.1. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 2 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 3: Approve the issuance of equity securities up to an additional 10% of our issued capital over a 12 month period, pursuant to ASX Listing Rule 7.1A, on the terms and conditions disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 3 requires the affirmative vote of at least 75% of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 4: Approve the grant of stock options, restricted stock units and performance stock units to Nancy Lurker on the terms disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 4 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal Nos.5-9: Approve the annual grants of stock options and deferred stock units to each of David J. Mazzo, Michael W. Rogers, Douglas Godshall, James Barry and Jay Duker on the terms disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval

|

| of Proposal Nos. 5 through 9 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal.

|

| • | | Proposal No. 10: Approve the initial grant of stock options to Kristine Peterson on the terms disclosed in this proxy statement. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 10 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 11: Approve, on an advisory basis, our executive compensation as disclosed in this proxy statement.Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 11 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will have no effect on the outcome of this proposal, and abstentions will have the effect of anAGAINST vote on this proposal. |

| • | | Proposal No. 12: Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018. Votes may be cast:FOR,AGAINST orABSTAIN. The approval of this Proposal No. 12 requires the affirmative vote of a majority of the votes properly cast on the matter. Brokernon-votes will not occur in connection with this proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on the ratification of independent registered public accounting firms under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions will have the effect of anAGAINST vote on this proposal. |

Proxy Solicitation

We will bear the cost of preparing, assembling, printing, mailing, and distributing these proxy materials. If you choose to vote over the Internet, you are responsible for Internet access charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We have retained The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and to provide related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed US$15,000. In addition to soliciting stockholders through our employees, we will request banks, brokers and other intermediaries holding shares of our Common Stock beneficially owned by others to solicit the beneficial owners and will reimburse them for their reasonable expenses in doing so.

VOTING INSTRUCTIONS

Voting Process for Stockholders

All shares of our Common Stock represented by a properly executed proxy received before the time indicated on the proxy will, unless the proxy is revoked, be voted in accordance with the instructions indicated on the proxy. If no instructions are indicated on the proxy, the shares will be voted as the proxy holder nominated on the proxy card determines, or, if no person is nominated, the shares will be voted “FOR ALL” on Proposal No. 1 and “FOR”on Proposal Nos. 2 through 12 in accordance with the Board’s recommendations on each proposal. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment.

Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to vote in person, please bring proof of identification. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will

be counted if you later decide not to attend the Annual Meeting. Shares held in street name through a brokerage account or by a bank or other nominee may be voted in person by you if you obtain a valid proxy from the record holder giving you the right to vote the shares. CDI holders may attend the meeting, but cannot vote in person at the meeting.

Stockholders may submit a proxy in any of the following three ways:

By Internet: You may submit a proxy by Internet 24 hours a day through 1:00 a.m., December 15, 2017 (U.S. Eastern Standard Time) by following the instructions that are included on your enclosed proxy card. If you submit a proxy by Internet, you do not need to return your proxy card.

By Telephone: You may submit a proxy by telephone 24 hours a day through 1:00 a.m., December 15, 2017 (U.S. Eastern Standard Time) by following the instructions that are included on your enclosed proxy card. If you submit a proxy by telephone, you do not need to return your proxy card.

By Mail: You may submit a proxy by signing and returning the enclosed proxy card as indicated.

You may revoke your proxy at any time before it is voted by properly executing and delivering a later-dated proxy card, by later submitting a proxy by Internet or telephone, by delivering a written revocation to our Secretary or by attending the Annual Meeting, requesting a return of your proxy and voting in person.

Although we encourage stockholders to submit a proxy by Internet, telephone or mail, whether or not they attend the Annual Meeting, stockholders also may vote by attending, and voting in person at, the Annual Meeting.

Voting Process for CDI Holders

CDI holders may cause the shares of common stock underlying their CDIs to be voted only by their written instructions to CDN. CDI holders should complete, sign and return the CDI Voting Instruction Form.

Computershare will collect and process voting instructions from CDI holders. Computershare must receive the CDI Voting Instruction Form, completed and returned in accordance with the instructions provided on the form, by no later than 1:00 p.m. December 12, 2017 Australian Western Standard Time (AWST).

A CDI holder may revoke a CDI Voting Instruction Form by delivering to Computershare, no later than 1:00 p.m. December 12, 2017 (AWST), a new CDI Voting Instruction Form or a written notice of revocation, in either case bearing a later date than the CDI Voting Instruction Form previously sent.

CDI holders may attend the Annual Meeting, but cannot vote in person at the Annual Meeting.

PROPOSAL 1

ELECTION OF SEVEN DIRECTORS

The Board currently consists of seven directors, David J. Mazzo, Nancy Lurker, Michael W. Rogers, Douglas Godshall, James Barry, Jay Duker and Kristine Peterson. Each of these directors has been nominated by the Board for election at the Annual Meeting. Each nominee, if elected, will hold office until our 2018 Annual Meeting of Stockholders and until his or herperson’s successor is duly elected and qualified, or until he or she sooner dies, resigns or is removed. The proposed nominees are not being nominated pursuantqualified.

| | | Proposal No. 2: | To approve, on an advisory basis, the compensation paid to any arrangement or understanding with any person. We do not anticipate that any nominee will become unavailable to serve. Biographical information and the attributes, skills and experience of each nominee that led our Governance and Nominating Committee and Board to determine that such nominee should servenamed executive officers, as a director are discusseddescribed in the “Directors and Executive Officers” section of this proxy statement.

| THE BOARD RECOMMENDS THAT YOU VOTE FOR ALL ON PROPOSAL NO. 1 TO ELECT DAVID J. MAZZO, NANCY LURKER, MICHAEL W. ROGERS, DOUGLAS GODSHALL, JAMES BARRY, JAY DUKER AND KRISTINE PETERSON TO THE BOARD.

| | Proposal No. 3: | DIRECTORS AND EXECUTIVE OFFICERSTo ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

|

See the “Proposals” section of this Proxy Statement for information on these proposals. We will also consider any other business that is properly brought before the Annual Meeting or any adjournments or postponements thereof. See “What happens if additional matters are presented at the Annual Meeting?” below. How does the Board of Directors recommend that I vote? Our Board recommends that you vote your shares as follows: | | Board

Recommendation | | | | Proposal No. 1: | The election of seven members of our Board of Directors, or the Board, consists of seven (7) members. The term of each director expires each year atto serve until our 2023 Annual Meeting of Stockholders. Each director also continues to serve as a directorStockholders or until his or hersuch person’s successor is duly elected and qualified, or until he or she sooner dies, resigns, or is removed. qualified. | FOR ALL | | | | Proposal No. 2: | The following table sets forthapproval, on an advisory basis, of the name, age, director service period and position of each ofcompensation paid to our current directors,named executive officers, as of November 10, 2017:described in this proxy statement. | | | | | | | | | Name | | Age | | | Position | | Director Since | David Mazzo | | | 60 | | | Chairman of the Board of Directors | | 2005 | Nancy Lurker | | | 59 | | | President and Chief Executive Officer and Director | | 2016 | Michael Rogers | | | 57 | | | Director | | 2005 | Douglas Godshall | | | 53 | | | Director | | 2012 | James Barry | | | 58 | | | Director | | 2014 | Jay Duker | | | 59 | | | Director | | 2016 | Kristine Peterson | | | 58 | | | Director | | 2017 |

| Set forth below for each current director is a list of Board Committee memberships and a description of his or her business experience, qualifications, education and skills that led our Board to conclude that such individual should serve as a member of our Board:FOR

| David J. Mazzo, Ph.D.

| Chairman

| | Proposal No. 3: | The ratification of the Board, Chairmanappointment of Deloitte & Touche LLP as our independent registered public accounting firm for the Compensation Committee and memberfiscal year ending December 31, 2022. | FOR |

See the “Proposals” section of this Proxy Statement for information on these proposals and our Board’s recommendations. What happens if additional matters are presented at the Annual Meeting? Other than the three items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Nancy S. Lurker, President and Chief Executive Officer, and Ron I. Honig, Chief Legal Officer and Company Secretary, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting or any adjournments or postponements thereof. If, for any reason, any of the director nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our Board of Directors. How many votes do I have? There were 34,047,128 shares of common stock issued and outstanding as of the close of business on the Record Date. Each share of our common stock that you own as of the Record Date entitles you to one vote on each matter presented at the Annual Meeting. Cumulative voting for directors is not permitted. 2

What is the difference between holding shares as a “stockholder of record” as compared to as a “beneficial owner”? Most of our stockholders hold their shares as a beneficial owner through a broker, bank, trust or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. | • | Stockholder of Record: If your shares are registered directly in your name with our transfer agent, Computershare Trust Company N.A., you are considered, with respect to those shares, the Governance and Nominating Committee andstockholder of record. As the Science Committee Dr. Mazzo has beenstockholder of record, you have the Chief Executive Officer and a director of Caladrius Biosciences, Inc., a Nasdaq Stock Market LLC,right to grant your voting proxy directly to us or NASDAQ, listed company, since January 2015. Caladrius is a clinical stage development company with a pipeline of cell therapy product candidates in autoimmune disease (type I diabetes) and select cardiovascular indications. Prior to joining Caladrius, Dr. Mazzo served from August 2008 to October 2014 as Chief Executive Officer and as a member ofvote personally at the board of directors of Regado Biosciences, Inc., a NASDAQ-listed biopharmaceutical company focused on Annual Meeting. You will need the development of novel antithrombotic drug systems for acuteand sub-acute cardiovascular indications. Prior to his leading Regado, from March 2007 to April 2008, Dr. Mazzo was President, Chief Executive Officer and a director of Æterna Zentaris, Inc., a publicly held international biopharmaceutical company. From 2003 until 2007, Dr. Mazzo served as President, Chief Executive Officer and a director of Chugai Pharma USA, LLC, a biopharmaceutical company which was the U.S. subsidiary of Chugai Pharmaceutical Co., Ltd. of Japan. Dr. Mazzo has also held senior management and executive positions in research and development and/control or directorships with the Essex Chimie European subsidiary at Schering-Plough Corporation, a publicly held pharmaceutical company that was subsequently acquired by Merck & Co., Inc.; Hoechst Marion Roussel, Inc., the U.S. subsidiary of Hoechst AG, which was subsequently acquired by Sanofi, a multinational pharmaceuticals company; and Rhone-Poulenc Rorer, Inc., a subsidiary of Rhone-Poulene SA, a French pharmaceuticals company, which was subsequently acquired by Hoechst AG. He also previously served on the board of directors of Avanir Pharmaceuticals, Inc., a specialty pharmaceutical company, from 2005 until Avanir was sold to Otsuka Holdings in 2015. Dr. Mazzo earned a B.A.account number included in the Honors Program (Interdisciplinary Humanities) and a B.S. in Chemistry from Villanova University. In addition, Dr. Mazzo received his M.S. in chemistry and his Ph.D. degree in analytical chemistry from the University of Massachusetts, Amherst. He was also a research fellow at the Ecole Polytechnique Federale de Lausanne, Switzerland. We believe Dr. Mazzo is qualified to serve on our Board because his extensive experience as an executive officer and directorNotice or your proxy card or included in the life sciences industry, his understanding ofemail to you if you received the strategic and regulatory

environmentproxy materials by email in which we conduct our business, his lengthy track record in global product development, his Ph.D. in analytical chemistry and his broad scientific and managerial background provide him expertiseorder to be able to vote your shares or submit questions during the Annual Meeting. If you do not wish to vote personally or you will not be attending the Annual Meeting, you may vote by proxy over the Internet by following the instructions provided in the oversightNotice, or, if you requested a printed or email copy of companies in this sector andthese proxy materials, you can also vote by telephone or mail by following the ability to guide such companies through varying operating climates.

Nancy Lurker

President and Chief Executive Officer

Ms. Lurker has been our President and Chief Executive Officer since September 2016. From 2008 to 2015, Ms. Lurker served as President and Chief Executive Officer and a director of PDI, Inc., a NASDAQ-listed healthcare commercialization company now named Interpace Diagnostics Group, Inc. From 2006 to 2007, Ms. Lurker was Senior Vice President and Chief Marketing Officer of Novartis Pharmaceuticals Corporation, the U.S. subsidiary of Novartis AG. From 2003 to 2006, she served as President and Chief Executive Officer of ImpactRx, Inc., a privately held healthcare information company. From 1998 to 2003, Ms. Lurker served as Group Vice President, Global Primary Care Products and Vice President, General Therapeutics for Pharmacia Corporation (Pharmacia), now a part of Pfizer, Inc. She also served as a member of Pharmacia’s U.S. executive management committee. Previously, Ms. Lurker spent 14 years at Bristol-Myers Squibb Company, rising from a sales representative to Senior Director, Worldwide Cardiovascular Franchise Management. Ms. Lurker serves as chair of the board of directors of X4 Pharmaceuticals, Inc. and as a member of the board of directors of the Cancer Treatment Centers of America, both privately held companies. Ms. Lurker previously served as a member of the boards of directors of publicly held Auxilium Pharmaceuticals, Inc. from 2011 to 2015 and Mallinckrodt Pharmaceuticals, plc from 2013 to 2016, in addition to serving as a director of PDI, Inc. from 2008 to 2015. Ms. Lurker received a B.S. in Biology from Seattle Pacific University and an M.B.A. from the University of Evansville. We believe Ms. Lurker is qualified to serve on our Board because of her role as our President and Chief Executive Officer, as well as her broad ranging experienceinstructions contained in the pharmaceutical industry and her track record of maximizingproxy card that accompanied these materials. See “How can I vote my shares without attending the potential of new therapies and successfully implementing innovative U.S. and global drug launches, which provide her with valuable expertise and perspective on our corporate strategy, management, operations and governance.Annual Meeting?” below.

Michael Rogers

Chairman of the Audit and Compliance Committee and member of the Compensation Committee

Mr. Rogers served as the Chief Financial Officer of Acorda Therapeutics, Inc., a biotechnology company focused on neurological disorders, from October 2013 until October 2016. From June 2009 to October 2012, Mr. Rogers served as Executive Vice President and Chief Financial Officer of BG Medicine, Inc., a company focused on the development of novel biomarker-based diagnostics. Mr. Rogers was Executive Vice President, Chief Financial Officer and Treasurer of Indevus Pharmaceuticals Inc., a specialty pharmaceutical company, from February 1999 until April 2009. Mr. Rogers was previously Executive Vice President and Chief Financial and Corporate Development Officer at Advanced Health Corporation, a health care information technology company, Vice President, Chief Financial Officer and Treasurer of AutoImmune, Inc., a biopharmaceutical company, and Vice President, Investment Banking at Lehman Brothers, Inc. and at PaineWebber, Inc. Mr. Rogers is the chairman of the board of directors of Keryx Biopharmaceuticals, Inc., a biopharmaceutical company focused on bringing innovative medicines to people with renal disease. Mr. Rogers was previously a director of Coronado Biosciences, Inc. We believe Mr. Rogers is qualified to serve on our Board because of his significant experience as CFO of various companies and as an investment banker have provided him with expertise in strategic transactions, corporate operations, financial management, taxes, accounting, controls, finance and financial reporting in the life sciences industry as well as valuable insight into the strategy of our company.

Douglas Godshall

Chairman of the Governance and Nominating Committee and member of the Compensation Committee

Mr. Godshall serves as President and Chief Executive Officer at Shockwave Medical, a privately held company which is creating and commercializing interventional devices designed to better address patients with

problematic cardiovascular calcification. Previously, he served as the Chief Executive Officer of HeartWare International, Inc., a NASDAQ-listed company, and its predecessor HeartWare Limited, a medical device company focused on heart failure, from September 2006 until August 2016 and as director from October 2006 until August 2016. HeartWare was acquired by Medtronic PLC in August 2016. Prior to joining HeartWare Limited, Mr. Godshall served in various executive and managerial positions at Boston Scientific Corporation, where he had been employed since 1990, including as a member of Boston Scientific’s Operating Committee. From January 2005 he served as President, Vascular Surgery, and for the prior five years as Vice President, Business Development, focused on acquisition strategies for the cardiology, electrophysiology, neuroradiology and vascular surgery divisions. Mr. Godshall has a Bachelor of Arts in Business from Lafayette College and Masters of Business Administration from Northeastern University. Mr. Godshall has served on the board of directors of Vital Therapies, Inc., a public company traded on NASDAQ that develops cell-based therapies for the treatment of liver disease, since May 2013, and the board of directors of the Medical Device Manufacturers Association, a national trade association, since May 2014. We believe Mr. Godshall is qualified to serve on our Board because his managerial experience at public, life sciences companies provides him insights as a successful life sciences entrepreneurwith in-depth knowledge of medical product strategy and development.

James Barry, Ph.D.

Member of the Audit and Compliance Committee and the Science Committee

Dr. Barry has been the President and Chief Executive Officer of InspireMD, a global medical device company focused on the development and commercialization of vascular products, since June 2016 and has served on the board of directors of Inspired MD since January 2011. Prior to this, he served as the Executive Vice President and Chief Operating Officer of InspireMD. Prior to joining InspireMD, Dr. Barry served as Executive Vice President and Chief Operating Officer of Arsenal Medical from August 2011 until September 2012, and as President and CEO and Director from September 2012 until December 2013. Dr. Barry has been the Principal Founder at Convergent Biomedical Group since September 2010. Dr. Barry served in various executive and managerial positions at Boston Scientific Corporation, where he had been employed from 1992 until 2010, including as a member of Boston Scientific’s Operating Committee. From 2007 through 2010 he served as Senior Vice President, Corporate Technology Development, responsible for the global research and development function, and for the prior six years he served as Vice President, Corporate Research and Advanced Technology Development. Dr. Barry is also a director of AgNovos Healthcare LLC and Cardiac Implants and in the past also served as a director of MicroChips Corporation. Dr. Barry has a Bachelor of Arts in Chemistry from St. Anselm College and a Ph.D. in Biochemistry from the University of Massachusetts. We believe Dr. Barry is qualified to serve on our Board because his significant experience developing products, leading research and development teams and building successful businesses, coupled with his expertise in advising clients in the pharmaceutical, biotechnology and medical device industries, brings valuable technical expertise and commercial experience to our company.

Jay Duker, M.D.

Chairman of the Science Committee and member of the Governance and Nominating Committee

Dr. Duker is the Director of the New England Eye Center, where he has served in various capacities since 1992. He is also Professor and Chairman of Ophthalmology at Tufts Medical Center and Tufts University School of Medicine. He has published more than 200 journal articles related to ophthalmology andis co-author of Yanoff and Duker’s Ophthalmology, a best-selling ophthalmic text. Dr. Dukeris co-founder of three companies, including Hemera Biosciences, Inc., a privately held company seeking to develop anti-compliment gene-based therapies for the treatment of dry andwet age-related macular degeneration. Dr. Duker serves as a director of Hemera and Eleven Biotherapeutics, a publicly held biopharmaceutical company advancing a broad pipeline of novel anti-cancer agents based on its Targeted Protein Therapeutics. Dr. Duker received an A.B. from Harvard University and an M.D. from the Jefferson Medical College of Thomas Jefferson University. We believe Dr. Duker is qualified to serve on our Board because his extensive clinical and academic experience and

expertise in ophthalmology coupled with his leadershipas co-founder of other life sciences companies provide him with valuable clinical, scientific and commercial insight to bring to our company.

Kristine Peterson

Member of the Audit and Compliance Committee and the Governance and Nominating Committee

Ms. Peterson has over 30 years of healthcare industry experience. She most recently served from 2009 to 2016 as Chief Executive Officer of Valeritas, Inc., a medical technology company focused on innovative drug delivery systems, and as a strategic advisor to Valeritas until August 2017. Prior to that, Ms. Peterson served as Company Group Chair of Johnson & Johnson’s biotech groups from 2006 to 2009, and as Executive Vice President of Johnson & Johnson’s global strategic marketing organization from 2004 to 2006. Prior to that, she served as Senior Vice President, Commercial Operations for Biovail Corporation, a pharmaceutical company, and President of Biovail Pharmaceuticals from 2003 to 2004. Ms. Peterson began her career at Bristol-Myers Squibb, holding assignments of increasing responsibility spanning marketing, sales and general management, including running a cardiovascular / metabolic business unit and a generics division. Ms. Peterson is also a director of Paratek Pharmaceuticals, Inc., Immunogen, Inc. and Amarin Corporation plc, and within the past five years also served as a director of Valeritas, Inc. Ms. Peterson earned a B.S. and M.B.A. from the University of Illinois at Champaign Urbana. We believe Ms. Peterson is qualified to serve on our Board because of her extensive executive management and sales and marketing experience in both large, multinational pharmaceutical and smaller biotechnology companies, in particular as it relates to later-stage development and commercialization, as well as her other public company board experience.

|

Beneficial Owner: If your shares are held through a broker, bank, trust or other nominee, like the majority of our stockholders, you are considered the beneficial owner of shares held in street name, and the Notice was forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank, trustee, or other nominee how to vote the shares in your account. Since a beneficial owner is not the stockholder of record, you may not vote your shares personally at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting. If you do not wish to vote personally or you will not be attending the Annual Meeting, you may vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested a printed or email copy of these proxy materials, you can also vote by telephone or by mail by following the instructions on the voting instruction card provided to you by your broker, bank, trustee, or other nominee. See “How can I vote my shares without attending the Annual Meeting?” below. How can I vote my shares personally at the Annual Meeting? You may vote your shares held in your name as the stockholder of record personally while participating in the Annual Meeting live via the Internetatwww.meetnow.global/MGNZNG2 using your unique control number that was included in the Notice that you received in the mail, or, if you requested to receive a printed or email copy of these proxy materials, the proxy card that accompanied these materials. If your shares are held beneficially in street name, you may still vote them at the Annual Meeting live via the Internet at www.meetnow.global/MGNZNG2 only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting live via the Internet, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting personally. How can I vote my shares without attending the Annual Meeting? Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. Stockholder of Record: If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested a printed or email copy of these proxy materials, you can also vote by telephone or mail by following the instructions on the proxy card that accompanied these materials. Beneficial Owner: If you hold shares beneficially in street name, you may also vote by proxy over the Internet by following the instructions provided in the voting instructions provided to you by your broker, bank, trustee or other nominee, or, if you requested to receive a printed or email copy of these proxy materials, you can also vote by telephone or mail by following the instructions on the voting instruction card provided to you by your broker, bank, trustee, or other nominee. 3

Can I change my vote or revoke my proxy? If you are the stockholder of record, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by: granting a new proxy bearing a later date by following the instructions provided in the Notice or, if you requested to receive a printed or email copy of these proxy materials, the proxy card that accompanied these materials; providing a written notice of revocation to our Company Secretary at 480 Pleasant Street, Suite A210, Watertown, MA 02472, which notice must be received by our Company Secretary before the Annual Meeting; or attending the Annual Meeting live via the Internet and voting personally. If you hold shares beneficially in street name, you may change your vote by: submitting new voting instructions to your broker, bank, trustee, or other nominee by following the instructions provided in the voting instructions sent to you by your broker, bank, trustee or other nominee; or, if you have obtained a valid legal proxy and control number from your broker, bank, trustee, or other nominee giving you the right to vote your shares, by attending the Annual Meeting via the Internet and voting personally using the valid legal proxy. Note that for both stockholders of record and beneficial owners, attendance at the Annual Meeting will not cause your previously granted proxy or voting instructions to be revoked unless you specifically so request or vote via the Internet personally at the Annual Meeting. Is my vote confidential? Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our Company or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. What is a “broker non-vote”? If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker, bank, trustee or other nominee with voting instructions, your shares may constitute “broker non-votes”. Broker non-votes occur on a matter when the broker, bank, trustee or other nominee is not permitted under applicable stock exchange rules to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Proposal Nos. 1 and 2 are considered “non-routine” matters, while Proposal No. 3 is considered a “routine” matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, your shares will not be voted on Proposal Nos. 1 and 2, and a broker non-vote will occur on these matters. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered voting power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. Because Proposal No. 3 is a “routine” matter, a broker, bank, trustee or other nominee will be permitted to exercise its discretion on this proposal, which means there will be no broker non-votes on this matter. How many shares must be present or represented to conduct business at the Annual Meeting? A “quorum” is necessary to conduct business at the Annual Meeting. A quorum is established if the holders of one-third of all shares issued and outstanding and entitled to vote at the Annual Meeting are present at the Annual Meeting, either in person via virtual communication or represented by proxy. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum at the Annual Meeting. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. What are the voting requirements to approve the proposals discussed in this Proxy Statement? Proposal No. 1: Election of seven directors to the Board. Votes may be cast: FOR ALL nominees, WITHHOLD ALL nominees or FOR ALL EXCEPT those nominees noted by you on the appropriate portion of your proxy or voting instructions. A plurality of the votes of the shares present personally or represented by proxy at the Annual Meeting is required to elect director nominees, and as such, the seven nominees who receive the greatest number of votes cast by stockholders entitled to vote on the matter will be elected. Broker non-votes and abstentions will have no effect on the outcome of this proposal. 4

Proposal No. 2: Approve, on an advisory basis, the compensation paid to our named executive officers as disclosed in this proxy statement. Votes may be cast: FOR, AGAINST or ABSTAIN. The approval of this Proposal No. 2 requires the affirmative vote of a majority of the votes properly cast on the matter. Broker non-votes and abstentions will have no effect on the outcome of this proposal. Proposal No. 3: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Votes may be cast: FOR, AGAINST or ABSTAIN. The approval of this Proposal No. 3 requires the affirmative vote of a majority of the votes properly cast on the matter. Broker non-votes will not occur in connection with this proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on this proposal under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions will have no effect on the outcome of this proposal. Who will bear the cost of soliciting votes for the Annual Meeting? We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Our directors, officers and employees may solicit proxies or votes in person, by telephone or by electronic communication. We will not pay our directors, officers or employees any additional compensation for these services. We will ask brokers, banks, trustees and other nominees to forward the proxy materials to their principals and to obtain authority to execute proxies and will reimburse them for certain costs in connection therewith. Who will count the votes? Votes will be counted by the inspector of election appointed for the Annual Meeting. Where can I find the voting results of the Annual Meeting? We will announce preliminary voting results at the Annual Meeting and disclose the final voting results in a Current Report on Form 8-K that we will file with the SEC within four business days of the Annual Meeting. Attending the Annual Meeting Why is the Annual Meeting being held virtually? By hosting the Annual Meeting online, we are able to communicate more effectively with our stockholders, enable increased attendance and participation from locations around the world, reduce costs and increase overall safety for both EyePoint and its stockholders. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. You will be able to vote online during the Meeting, change a vote you may have submitted previously, or ask questions online that will be reviewed and answered by the speakers. You will only be able to participate in this manner if you log in with your holder control number. Can I submit a question for the Meeting? Stockholders who attend the Annual Meeting by webcast by visiting www.meetnow.global/MGNZNG2 will have an opportunity to submit questions in writing during a portion of the Annual Meeting. Instructions for submitting a question during the Annual Meeting will be provided on the Annual Meeting website. We will endeavor to answer as many submitted questions as time permits; however, we reserve the right to exclude questions regarding topics that are not pertinent to Annual Meeting matters or company business or are inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Any questions that are appropriate and pertinent to the Annual Meeting but cannot be answered during the Annual Meeting due to time constraints will be answered and posted on the “Investors – Governance Documents” page of our Company’s website at www.eyepointpharma.com, as soon as practicable after the Annual Meeting. What should I do if I need technical support during the Annual Meeting? The Annual Meeting platform is fully supported across browsers and devices running the most updated version of applicable software and plugins. Attendees should ensure they have a strong internet connection, allow plenty of time to log in, and can hear streaming audio prior to the start of the Annual Meeting. 5